A Free Talk for Artists on Navigating Tax Laws

August 23, 7-9 p.m.

The MAIN

24266 Main St.

Santa Clarita, CA 91321

In “Taxes and the Artist,” tax expert Scott Rubenstein will go over the basics of how artists should properly navigate through the tax system. Wondering as an artist what can you write-off as an expense, how do you determine which taxes to pay, or what steps do you need to take to work most effectively and within the law?

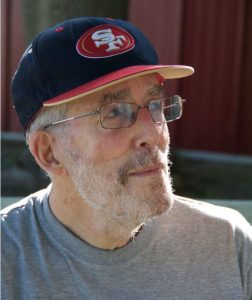

Mr. Scott Rubenstein has co-owned L.A. Tax Service for the past 35 years, a boutique tax service that specializes in self-employed tax returns and people in the entertainment business. In addition to his tax work, Scott has written 30 television episodes and has also been on staff for “Star Trek: The Next Generation,” appeared on the “Daily Show,” and was chosen as funniest accountant in Los Angeles.

Some Questions That Will Be Addressed at This Talk

- Is there a suggested minimum income threshold that he can suggest?

- How to deal with Sales Tax?

- How to deal with Deductions?

- I would like to know everything besides art supplies that can be deducted from your taxes.

- Is it important to have a resale number?

- How much income of sales a year does it take to change from hobbyist to professional?

- If an artist makes less than they put out (expenses) in a year, can they still write off their expenses?

- How to handle taxes for work done in preparation for a commission prior to the actual creation. If a client pays for the hours spent in the design process, is there sales tax? If the client owns the design, is payment for the design process just regular income or is there sales tax too?

- What level of income from art triggers an artist to declare?

- In my case, I have a lot more outlay than income from my work. That brings up my next question: if your expenses from materials outweighs your income, how does this affect your tax status? In the case of a sculptor starting out, there are a lot of costs for tools and materials that may not be evident with an oil painter, for example. Depending on sales, the costs could far outweigh the income.